Austria – The Investment Control “Powerhouse”

By Dr. Regina Kröll and Dr. Johannes Barbist, Binder Grösswang

Disclaimer: This post was first published on the Binder Grösswang Law Blog

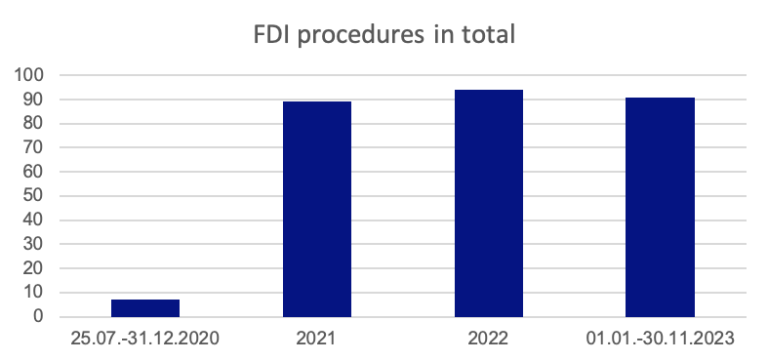

On 25 July 2020, the Austrian Investment Control Act (Investitionskontrollgesetz – ICA) entered into force and started a new era of foreign direct investment (FDI) screening in Austria.

This report aims at providing some key data around the operation of FDI screening in our country. In this exercise, we refrain from recycling the information collected and published by the European Commission in their three annual reports on the screening of foreign direct investments in the Union. We just wanted to stress again what the European Commission concluded in its latest annual report for the year 2022 (see here): Six Member States are responsible for the vast majority of notifications to the EU cooperation mechanism.

- 4 of them are large Member States (France, Germany, Italy and Spain),

- the remaining 2 (Denmark and Austria) are certainly smaller, but “grand” in FDI terms.

Also the European Court of Auditors’ Report has identified Austria as one of the most active member states in FDI Screening compared to average FDI stocks (see here at p. 27 and for a recent blog post covering the report here).

The first and (for the moment) only Activity Report on Investment Control of the Austrian FDI authority is already historic, covering the first 12 months of the new FDI screening regime in Austria (25 July 2020 – 24 July 2021), see here.

But thanks to a parliamentary question and a responsive Federal Minister of Labour and Economy, we now have a highly topical dataset for the period 25 July 2020 – 30 November 2023.

What the data show

Roughly 90 national FDI procedures are concluded each year (2021 – 2023).

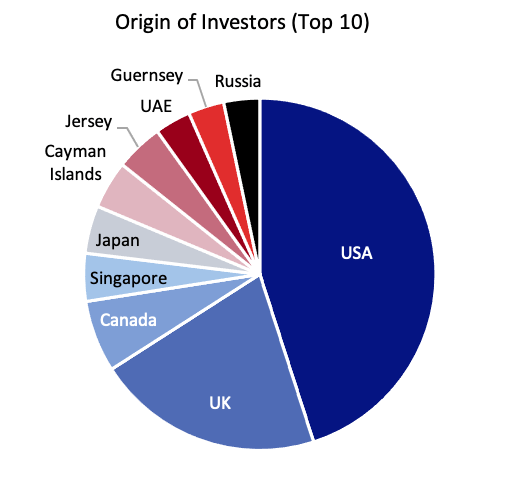

A closer look at (i) the sectors in which the Austrian target companies were active and (ii) the countries from where the foreign investors originated reveal the following:

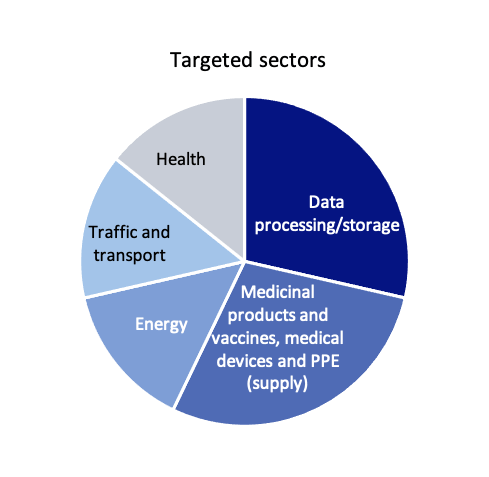

1) Period from 25 July – 31 December 2020

Sectors: The top 5 targeted sectors with the highest number of transactions were:

- data processing/storage,

- supply of medicinal products and vaccines, medical devices and personal protective equipment,

- energy,

- traffic and transport as well as

- health

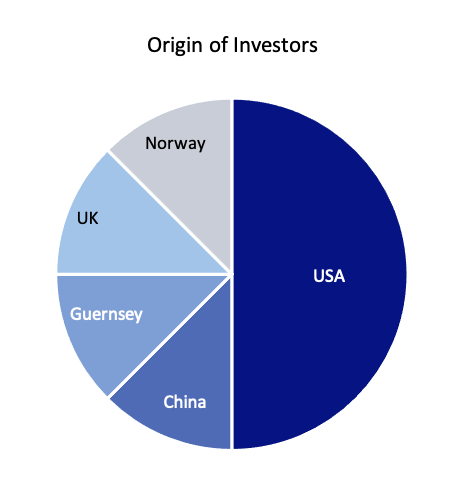

Origin of Investors: Of all cases in the reporting period, the main countries of origin of the investors were

- USA,

- China,

- Guernsey,

- UK and

- Norway

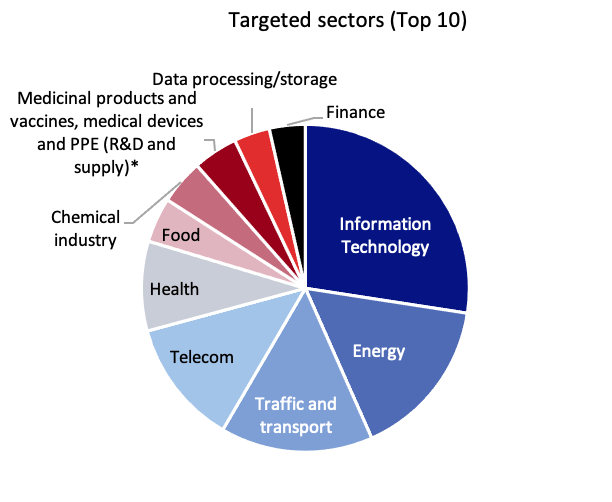

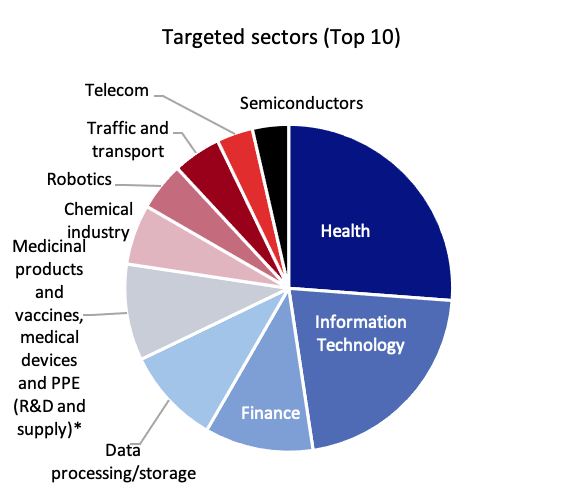

2) Year 2021

Sectors: The top 5 targeted sectors with the highest number of transactions were

- health,

- information technology,

- finance,

- data processing and storage as well as

- R&D and supply of medicinal products and vaccines, medical devices and personal protective equipment.*

* For better comparability of the figures we have combined R&D and supply in this field.

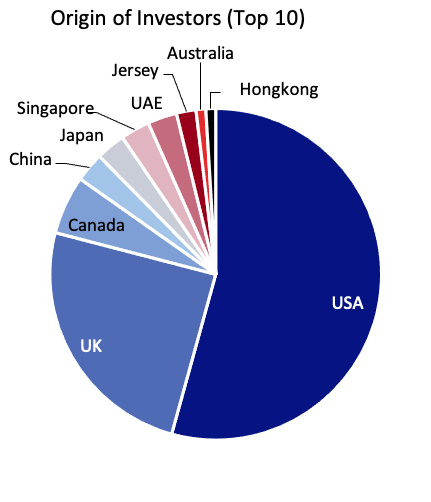

Origin of Investors: Of all cases in the reporting period, the main countries of origin of investors were

- USA,

- UK,

- Canada,

- China and

- Japan.

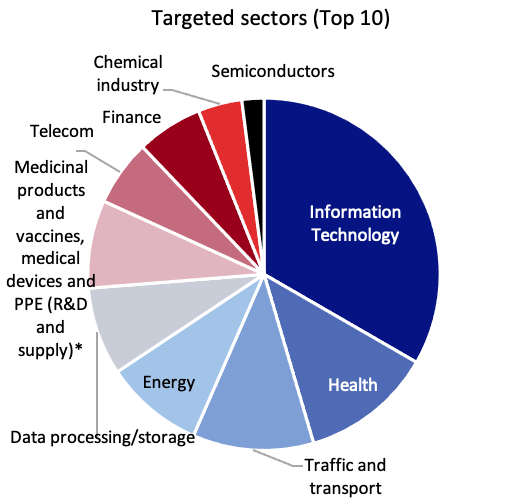

3) Year 2022

3) Year 2022

Sectors: The top 5 targeted sectors with the highest number of transactions were

- information technology,

- health,

- traffic and transport,

- energy as well as

- data processing and storage.

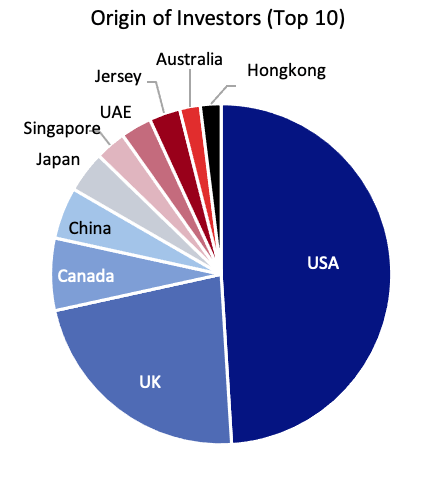

Origin of Investors: Of all cases in the reporting period, the main countries of origin of investors were

- USA,

- UK,

- Canada,

- China and

- Japan.

4) Period from 1 January – 30 November 2023

4) Period from 1 January – 30 November 2023

Sectors: The main targeted sectors with the highest number of transactions were

- information technology,

- energy,

- traffic and transport,

- telecom and

- health.

- USA,

- UK,

- Canada,

- Singapore and

- Japan.

What we expect in the future

What we expect in the future

The Austrian Government will closely study the Proposal of the European Commission on a revised FDI Screening Regulation (see here and for a recent analysis here) and the legislative developments in other EU Member States, and foremost in Germany. But we do not expect a reform of the Austrian FDI legislation in the short term.

Case numbers will stay at high levels keeping our FDI authority busy and most likely Austria securely in the Top 6 EU-jurisdictions.

Investors and their legal advisors should thus keep Austria on their “pocket list” of FDI jurisdictions to particularly pay attention to.

Interested to learn more about the Austrian Investment Control Act? Check out the Survival Guide Austrian Investment Control edited by the blog authors.

3) Year 2022

3) Year 2022

4) Period from 1 January – 30 November 2023

4) Period from 1 January – 30 November 2023 What we expect in the future

What we expect in the future